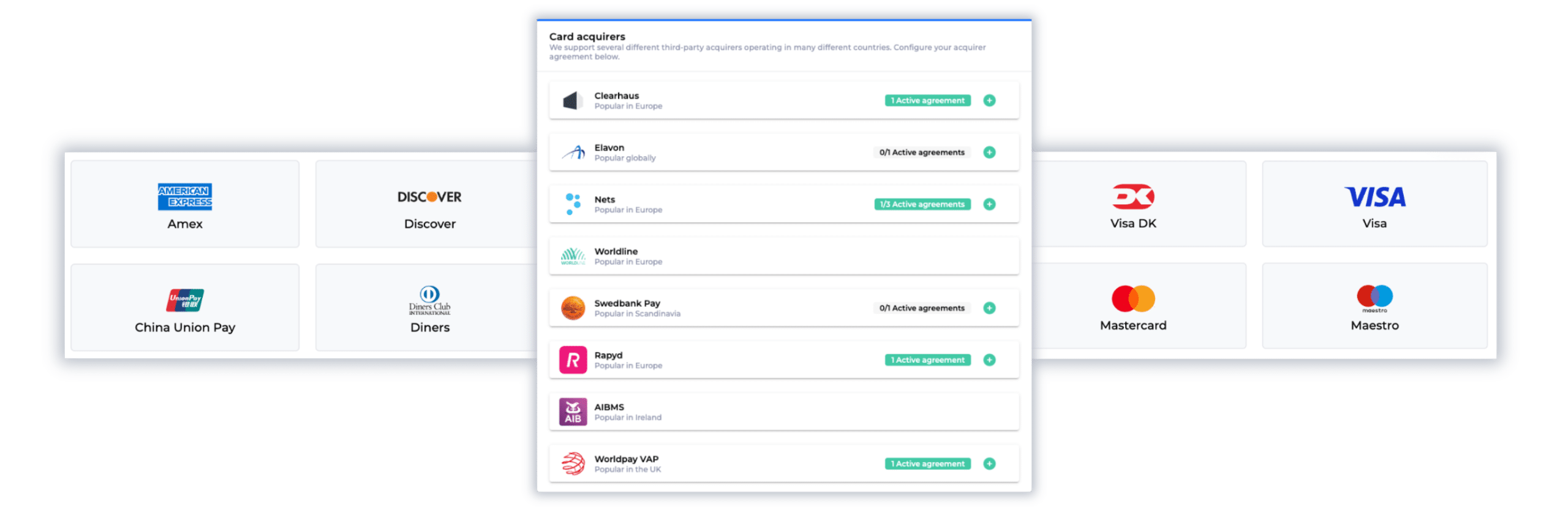

With an acquirer independent payment gateway, you have more choices for different market strategies, payment methods and rate optimization.

With an acquirer independent payment gateway, you have more choices for different market strategies, payment methods and rate optimization.

4000+ Customers are Growing with Billwerk+

4000+ Customers are Growing with Billwerk+

What you need to know

An acquirer is a bank who acts as an intermediary between the buyer and the issuing bank, and the acquirer is also responsible for the flow of data between the two parties.

To be able to accept payment cards in your online or physical store, you will need an acquiring agreement. When you sign an acquiring agreement you are ensured that the transaction between the card payment and your bank account works. Usually, these agreements come with fees (reversals, interchange fees, acquirer fees).

Read more about fees on our Billwerk+ Pay pricing page.

Why do You Need an Acquirer?

An acquirer is a bank who acts as an intermediary between the buyer and the issuing bank, and the acquirer is also responsible for the flow of data between the two parties.

To be able to accept payment cards in your online or physical store, you will need an acquiring agreement. When you sign an acquiring agreement you are ensured that the transaction between the card payment and your bank account works. Usually, these agreements come with fees (reversals, interchange fees, acquirer fees).

See more about our fees on our Billwerk+ Pay pricing page.

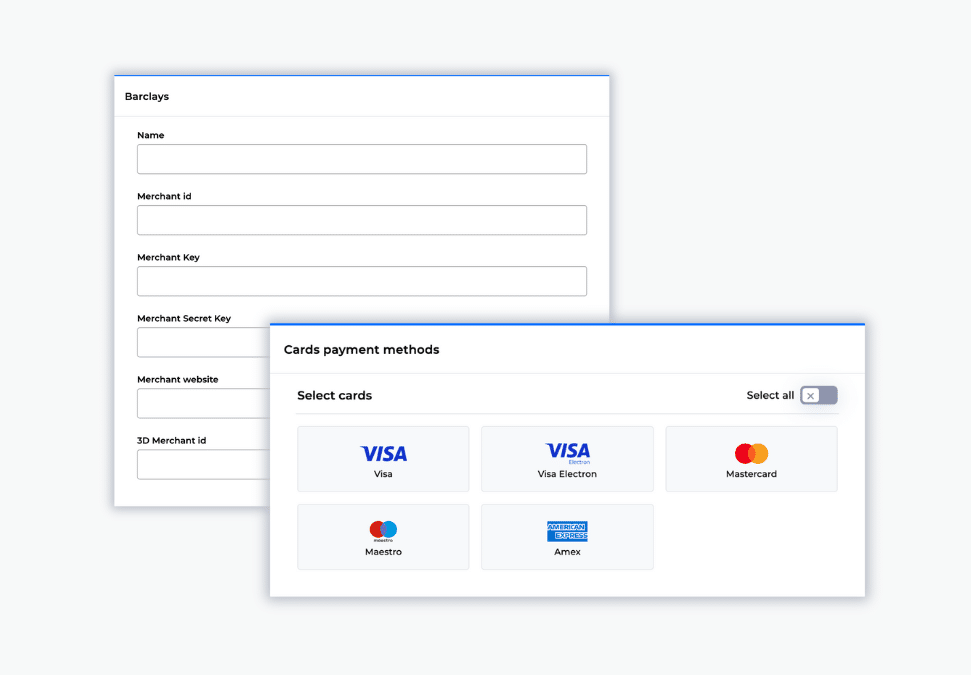

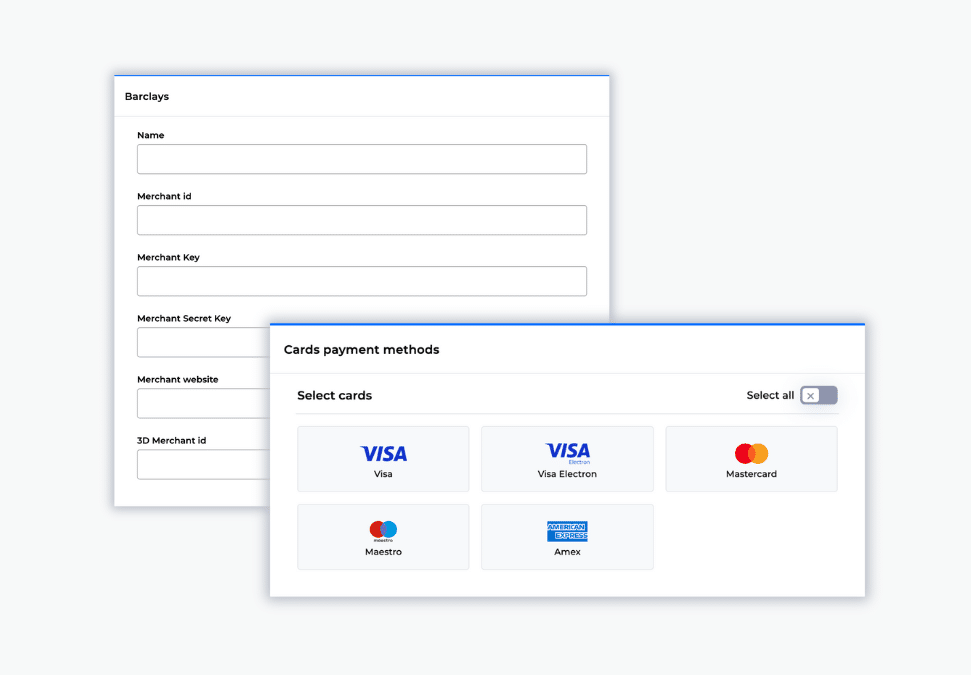

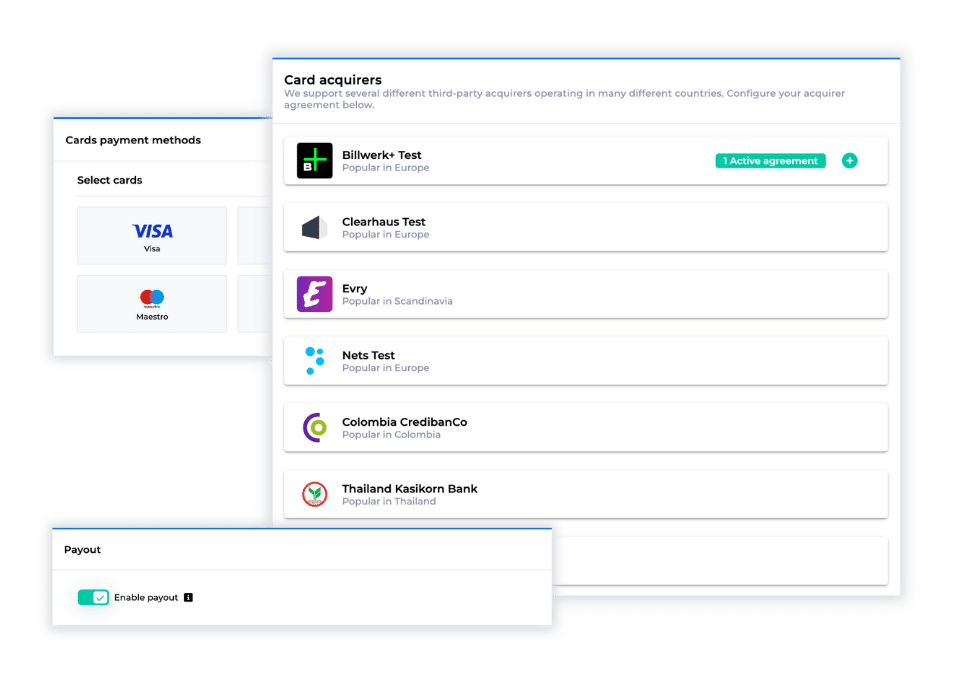

Most payment gateways are tied to one specific acquirer. However, depending on your market strategy, this is not always an advantage.

For example, for the Danish market, there is only one acquirer (Nets) that offers the most popular Danish payment card Dankort. With any other acquirer, a merchant would not be able to offer a preferred payment method for Danish customers and thus decrease conversions.

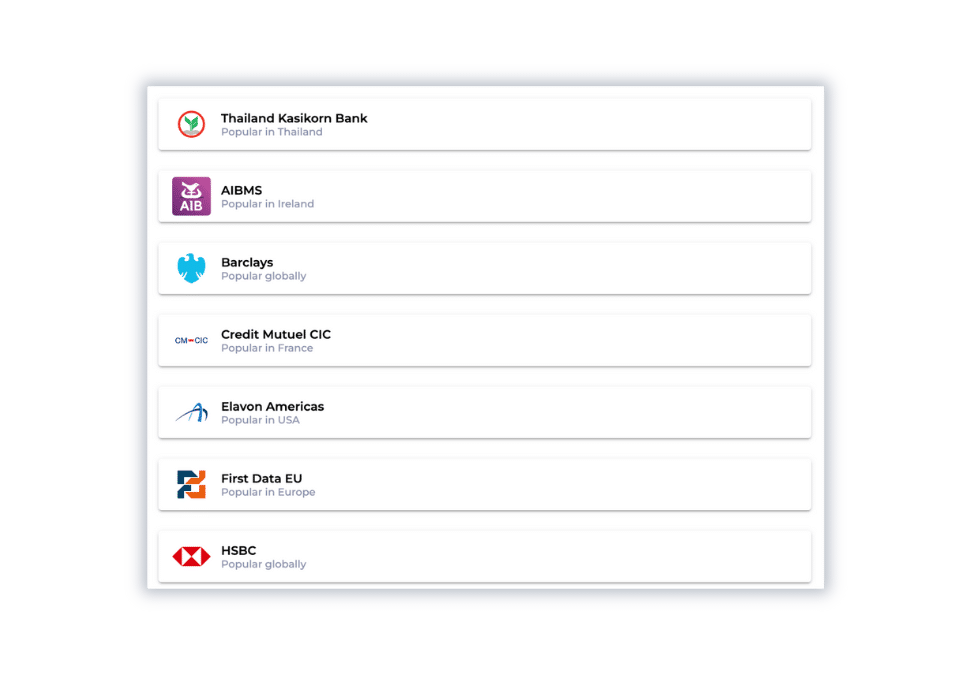

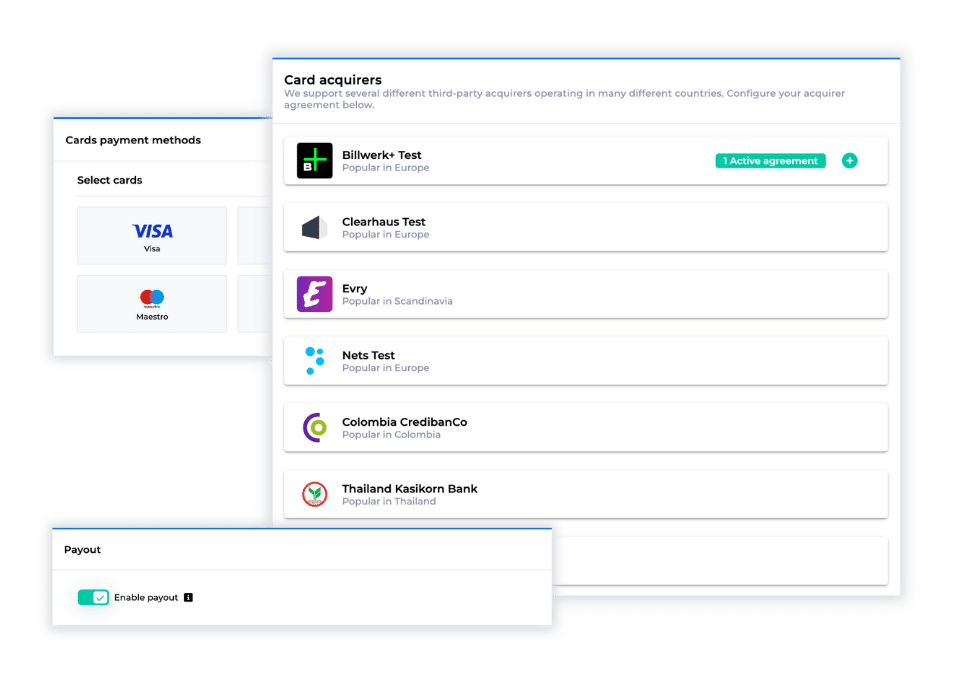

This enables you to expand your business into other countries by choosing acquirers that fit the local payment landscape.

Why is Billwerk+ Pay Acquirer Independent?

Most payment gateways are tied to one specific acquirer. However, depending on your market strategy, this is not always an advantage.

For example, for the Danish market, there is only one acquirer (Nets) that offers the most popular Danish payment card Dankort. With any other acquirer, a merchant would not be able to offer a preferred payment method for Danish customers and thus decrease conversions.

This enables you to expand your business into other countries by choosing acquirers that fit the local payment landscape.

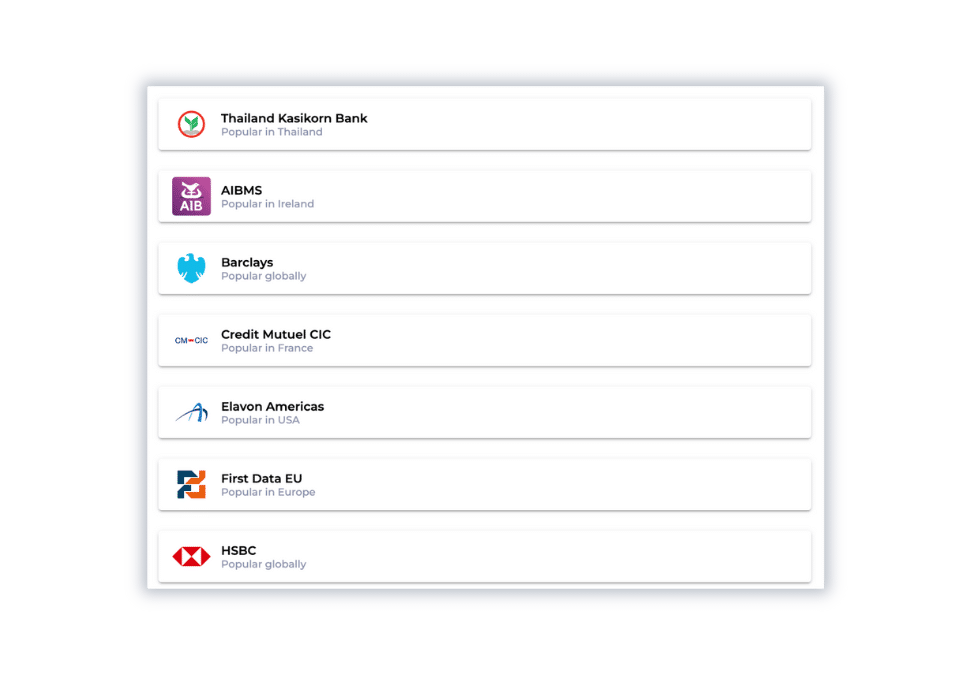

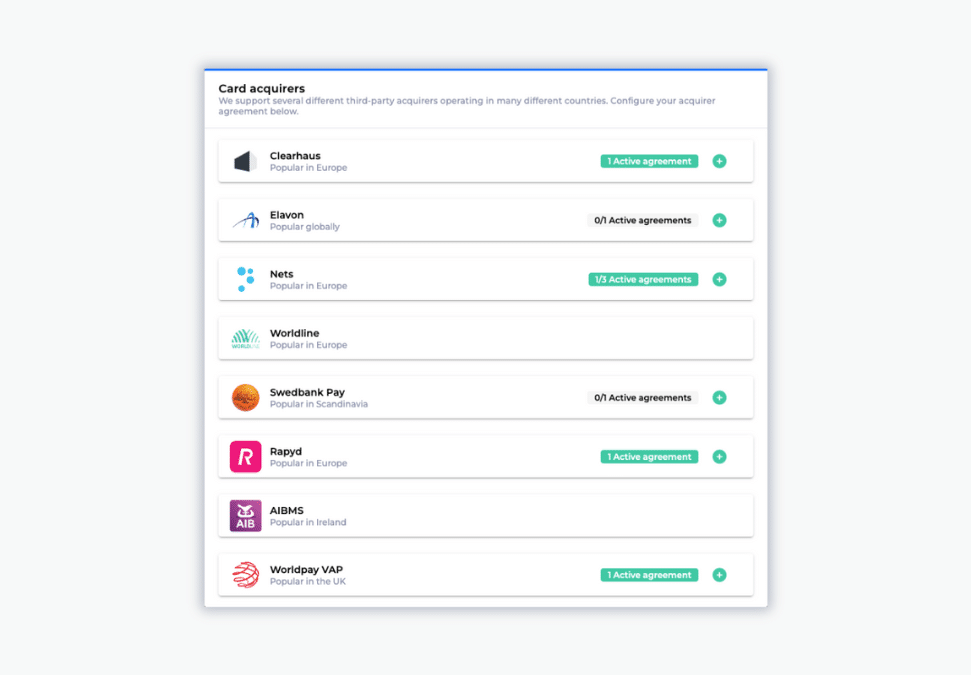

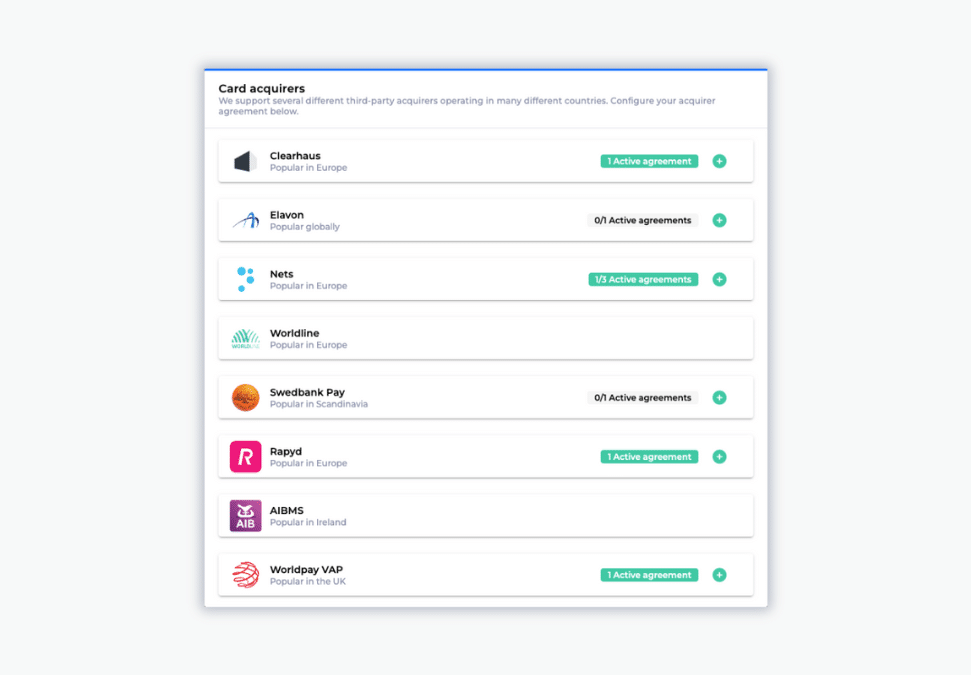

Thanks to Billwerk+ intelligent routing, you don’t have to make an active choice of acquiring service.

The intelligent routing selects your most suitable and favorably priced acquirer in our acquiring platform integrations, to suit your needs the best way possible.

Intelligent routing also has the benefit of quickly switching you to another acquiring service, should the one you use fail.

Intelligent Routing

Thanks to Billwerk+ intelligent routing, you don’t have to make an active choice of acquiring service.

The intelligent routing selects your most suitable and favorably priced acquirer in our acquiring platform integrations, to suit your needs the best way possible.

Intelligent routing also has the benefit of quickly switching you to another acquiring service, should the one you use fail.

Acquirers make sure that customer payment cards are valid and have enough credit to make a purchase.

- When your customers are shopping online, your payment gateway is handling their card data.

- The card data is then sent from your payment gateway to your acquirer.

- The acquirer checks if the customer’s payment card is valid and if there is enough money on it for the purchase.

- If everything is OK, the acquirer tells your payment gateway that the money is authorised for transaction.

- Your payment gateway can then settle the transaction.

- The payment gateway tells the acquirer that they can settle the money and charge your customer.

- The money will now be in the acquirer’s custody until you reach the agreed payout day.

- The acquirer transfers the money to your bank account.

How does Acquiring Work?

Acquirers make sure that customer payment cards are valid and have enough credit to make a purchase.

- When your customers are shopping online, your payment gateway is handling their card data.

- The card data is then sent from your payment gateway to your acquirer.

- The acquirer checks if the customer’s payment card is valid and if there is enough money on it for the purchase.

- If everything is OK, the acquirer tells your payment gateway that the money is authorised for transaction.

- Your payment gateway can then settle the transaction.

- The payment gateway tells the acquirer that they can settle the money and charge your customer.

- The money will now be in the acquirer’s custody until you reach the agreed payout day.

- The acquirer transfers the money to your bank account.