Spotlight Digital Wallets: Stats, facts, and numbers

A digital wallet is a usually cloud-based digital app that stores payment information and can be used to purchase things both online and in stores without having to use a physical card or cash.

Digital wallets are one of our trends 2024 because they make it much easier for customers and businesses alike to make one-time or recurring purchases. How do they do it? It’s all about efficiency.

Definition: What is a digital wallet?

A digital wallet is a usually cloud-based digital app that stores payment information and can be used to purchase things both online and in stores without having to use a physical card or cash.

As a cloud app, people can make payments via their phone which is also called “mobile payments” and is one feature of a digital wallet. However, digital wallets also make online shopping at the desktop easier, since they not only store payment information but also transactional information such as the address, phone number (if required), billing address, etc.

With a digital wallet, users therefore don’t have to type in this information every time they want to make a purchase. If the vendor offers digital wallets as payment methods and has them well integrated, customers can simply log into the app and share their customer data which saves time, reduces typing errors and makes it much easier to shop online.

Additionally, most digital wallets also take over banking functionalities such as sending money transfers, debit/credit cards, check cashing and e-check services.

The most popular digital wallets (facts & stats)

Apple Pay

Apple Pay was announced publicly 2014 and was – back then – based on a collaboration with American Express, Mastercard and Visa. The solution worked with single-use digital tokens that replaced the “traditional” transfer of personal card information (read more about tokens here).

Apple Pay can be used in over 83 countries, since it supports not just the most popular cards but also local card issuers (including Nordea or Swedbank cards in Sweden, Sparkasse or Commerzbank in Germany or Dankort in Denmark).

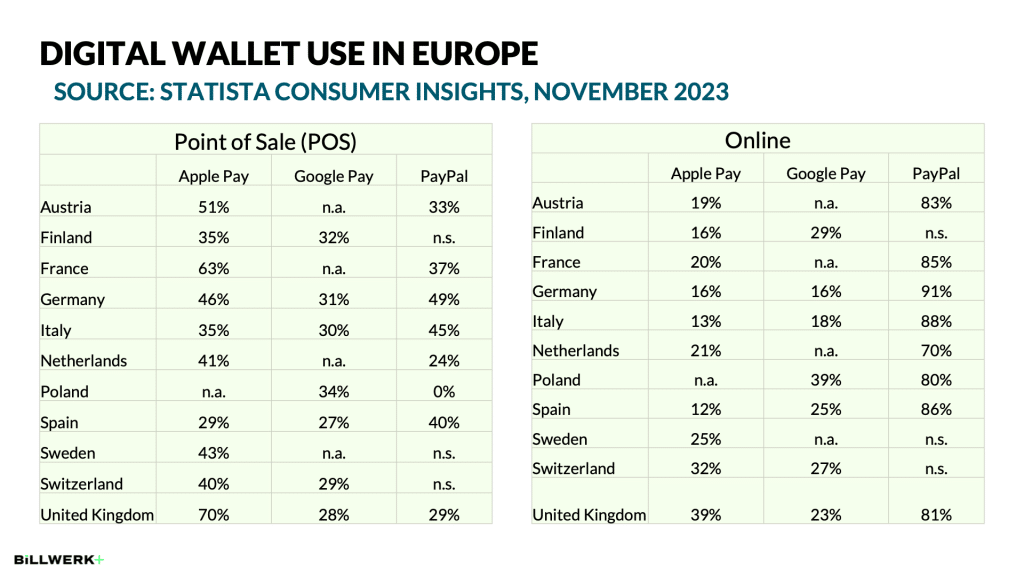

In and around Europe, the United Kingdom clearly dominates when it comes to Apple Pay usage both online and at Point of Sales (POS). In fact, it even beats the United States:

- United Kingdom: POS – 70% / Online – 39%

- France: POS – 63% / Online – 20%

- Switzerland: POS – 40% / Online – 32%

- Austria: POS – 51% / Online – 19%

- Sweden: POS – 43% / Online – 25%

- Netherlands: POS – 41% / Online – 21%

- Germany: POS – 46% / Online – 16%

- Finland: POS – 35% / Online – 13%

- Italy: POS – 35% / Online – 13%

- Spain: POS – 29% / Online – 12%

Source: Statista, November 2023

Google Pay

Although it might feel like Apple Pay was first (because the public consensus loves Apple as an innovator) Google Pay actually came out in May 2011 (back then, named “Google Wallet” which since then had its own renaissance), although its mobile apps took decidedly longer, releasing in 2018 for Android and iOS.

Google Pay and Google Wallet are – compared to Apple Pay – “only” available in 71 countries. But cover many local cards and payment providers which can be filtered by country here.

Google Pay has a much lower penetration than Apple Pay in and around European countries but manages to be more popular with some countries that are less enthused about Apple Pay, especially online.

- Poland: POS – 34% / Online – 39%

- Finland: POS – 32% / Online – 29%

- Switzerland: POS – 29% / Online – 27%

- Spain: POS – 27% / Online – 25%

- United Kingdom: POS – 28% / Online – 23%

- Italy: POS – 30% / Online – 18%

- Germany: POS – 31% / Online – 16%

Source: Statista, November 2023

PayPal

PayPal is probably the most popular digital wallet, entering the market under the less catchy name “Confinity” in as far back as 1998 (to put it into perspective: Facebook was founded in 2004, the first iPhone was released in 2007). Originally, it was pretty much tied to ebay which bought PayPal in 2002 to simplify payments for their users.

However, PayPal rather grew into the definition of a digital wallet that we have now, as the years went by.

When it comes to global availability, Paypal rules the market with more than 200 countries/regions and 25 currencies. It’s why it’s still considered a great base payment method if you’re planning for a global market presence.

In and around Europe, PayPal is especially popular in Germany which does make sense, given that Germans are notoriously hesitant to adopt new technologies and know PayPal since its early ebay days. Especially for online shops, it is ahead of Google Pay and Apple Pay by an incredibly wide margin.

- Germany: POS – 49% / Online – 91%

- Italy: POS – 45% / Online – 88%

- Spain: POS – 40% / Online – 86%

- France: POS – 37% / Online – 85%

- Austria: POS – 33% / Online – 83%

- United Kingdom: POS – 29% / Online – 81%

- Netherlands: POS – 24% / Online – 70%

- Poland: POS – 0% / Online – 80%

Source: Statista, November 2023

Choose wisely: why different digital wallets work for different markets & customers

As the statistics show, the use of digital wallets for stationary stores and especially online differs widely depending on the country (and according to a Savanta report, also depending on the age group).

It is therefore quite important to map out your market strategy and identify which countries are your main focus and which digital wallets are most popular there. Although we covered the most popular ones in this article, I’d like to add that there are very local options for different countries that act as digital wallets or mobile payments such as Klarna, MobilePay or Swish. Given that many customers can abandon their online shopping cart if their preferred payment method is not offered, it can increase your revenue significantly, if you know which methods are popular in which countries.

Did you know: in our payment gateway, we do not just provide you with more than 50 payment methods to choose from but also give you information on their popularity in European countries.

What do you need to consider when offering digital wallets?

Choosing and activating a payment method within your payment gateway differs depending on the method. Sometimes, you can simply activate it within the gateway. At other times, you need a business account on the payment provider’s page and maybe even an agreement / contract to get an ID or code that you can use within the payment gateway to activate the method. This can also come with external fees that are usually based on the purchase amount and tend to range between 1-3% of the overall purchase price.

In our help center for our payment gateway, we provide you with all the info you need when it comes to the most popular payment providers.