Visa Token Service – Automatic updates of cards on file

Developed in partnership with Visa, tokenisation is the next move in the payment industry’s development journey.

In October 2023, the payment card schemes will make it standard to use tokenisation for payment cards, and if you want to try it out now you can activate the new Visa Token feature in your Billwerk+ Platform in advance. As a service for you as a Billwerk+ user, the Visa Token Service will be automatically updated around October, to make sure you don’t miss out on all the benefits of tokenisation for your recurring payments.

But first, let’s get familiar with what the new Visa token feature is!

What is Visa Token Service?

A Visa payment card token replaces sensitive payment card data, such as the card number, expiration date, and CVV, with the unique identifier called a token. The token is a secure generated identification number, that heavily reduces the risk of theft or fraud during transactions and simplifies the payment process for merchants while securing customer information. The actual card data is hidden underneath the token, and never used in transactions. When the tokenised Visa cards are replaced by new cards, they will be automatically updated in the card scheme systems.

Why use Visa Token Service?

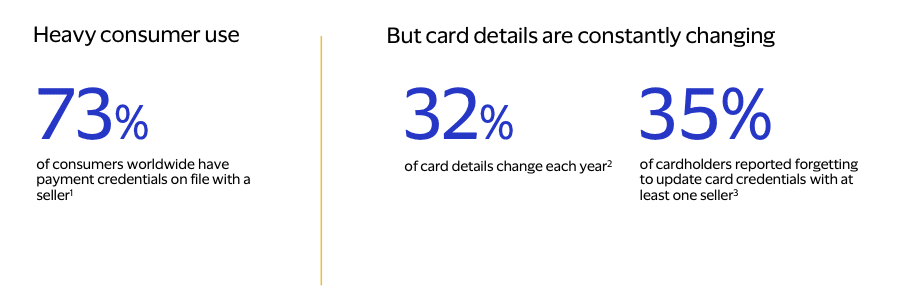

By saving the customers cards for recurring purchases in your e-commerce or subscription service, you create a more streamlined and better buyers experience for your customers. But with saved cards, also called card on file, and subscription payments comes the hassle of reminding procedures for customers to update their expired cards – and this is where Visa Token Service will become a great pain reliever for you!

- Get higher retention

- Reduce lost revenue

- Increase customer satisfaction with token service

Benefits of Visa Token Service

Improving your Visa recurring payments process to make it more secure and streamlined can help businesses increase customer trust and loyalty, leading to increased revenue and growth opportunities. Our partnership with Visa for Visa Token Service gives you an even greater level of protection for you and your customers throughout the entire payment journey:

Payment automation

The automatic update of cards provides a smoother payment experience for your recurring customers. Because of this they don’t have to remember to manually update outdated cards, or risk losing out on the products or services they enjoy with you due to outdated payment card data. As a result, the customer experience becomes more pleasant and positive, and will certainly save you some customer service phone calls from customers with payment problems!

Fraud protection

Visa states that tokenisation is one of the payment industry’s best defence against payment fraud, and we can only agree. Digital tokens are worthless to a fraudster, since they have no way to access and use the real payment card data.

No more “ghost subscribers”

With Visa Token Service activated you as a merchant won’t have to worry about loss of income from rejected payment due to expired card data. Similarly, this makes it convenient and easier for you as a consumer, as you don’t need to manually update your Visa card in your favourite e-commerce or on your subscription services such as media streaming, newspaper, box subscriptions and so on.

Let’s use an example: Company X has worked hard on onboarding their subscribers. Let’s call them LifeBox. Their conversion rate is high and the company has an average CLV of 18 months. 15% of the subscribers are very active, 70% of them are using the solution once in a while and the last 15% is with a low interaction. The so-called ‘ghost subscribers’. Not ideal, but okay. LifeBox has calculated that their CAC is around €12 and that the spend is higher than €500 a year. A good business. But, the dropout of subscribers is high. They lose around 5% of their business due to the cancellation of subscriptions. Not only just because of user action but due to an expired card. Their e-commerce manager has worked hard on the ‘get back’ campaigns along with spending on retargeting. Nevertheless, the customers seem to struggle to update their cards. Not only due to the user interface that is not always working but also due to the urgency.

With the new token service from Visa, the struggle is over. Now the subscription is no longer expired or creating troubles for the customer or for LifeBox, but now the only concern that is left for the e-commerce manager is to keep the ghost subscriber happy and find the value in the product.

Increased Customer Lifetime Value

The longer you keep a customer, the more customer lifetime value he or she brings to your business. With the improved payment experience and more streamlined subscription service you get with Visa Token Service, your customer satisfaction increases, resulting in increased customer loyalty and longer customer life. If the customers are satisfied with their consumer experience with you, the risk for churn is also decreasing. And considering that the CAC (cost of customer acquisition) generally is higher than the cost of maintaining your existing customers, providing a better, safer and more automated payment experience is a good choice.

In conclusion, it’s easy to see that for an e-commerce or subscription service, it is crucial to provide the customers with a seamless and secure digital payment experience. Therefore our partnership with Visa is the next move in the payment industry’s development journey, bringing a safer, stronger and more automated payment experience to you and your customers.

How do you get the Visa Token Service?

To get started using the Visa token feature for your Visa subscription management or recurring payments, all you have to do is to activate it in your Billwerk+ subscription administration panel by creating a Token Requester ID. This ID will then be used in your acquirer agreements. It’s important to keep in mind that your acquirer may charge a fee for using this feature. Currently Visa Token Service is applicable for cards on file and recurring payments with Visa payment cards in Billwerk+ Subscription.

Should you need any guidance or have any questions about how to take recurring payments online, Visa subscription management, Visa Token Service or other questions about payments and subscriptions, the Billwerk+ support team is here for you. Give us a call or send us an email, and we’ll be happy to help you!