AI-based claims management to increase the CLV

By Christian Zingel

How to increase CLV with AI-based claims management

Claims management: AI helps to increase CLV

The personalization of the customer journey should not stop just because a customer is late with their payment.

A personalized, data-driven approach enables the customer to be brought back into the buying cycle, thereby increasing customer lifetime value.

Increasing CLV with artificial intelligence

In the age of digital business models, customers have an enormous choice of offers, which makes it easier for them to switch quickly between providers. This confronts companies with new challenges.

At the same time, these business models also offer a wide variety of new and also necessary opportunities to address customers individually in the context of accounts receivable management and thus differentiate themselves from competitors due to a high information density. In this context, it is crucial to recognize the needs of a customer and to respond to them in the best possible way at different stages of the customer journey.

The consequences of late payment

Due to flexible contract design, companies in the subscription economy in particular are required to work on customer loyalty over the long term. The personalization of the customer journey offers enormous potential for long-term customer loyalty and consequently also increased customer lifetime value. However, the personalized customer experience often ends as soon as a customer defaults on a payment. A missed payment can have a wide variety of reasons. At this point, a customer should not be considered lost.

On the contrary, it is precisely in this sensitive phase that it is important to meet the customer at eye level and thus ultimately return him or her to the subscription. The right approach to claims management can therefore increase customer lifetime value and safeguard the company’s reputation.

In case of late payment, communication with the customer during the dunning and collection process is crucial. A customer-oriented and personalized approach can be based, for example, on whether a customer prefers to be contacted by e-mail or WhatsApp, in the evening or in the morning, or more formally than amicably. Our changing media behavior also plays an important role. We all look at our smartphones about 100 times a day and respond most quickly to messages here. So why don’t we in claims management – as part of the value chain – also communicate digitally with our customers?

Find out more about BILLWERK+ & scale your growth

Automate your subscription business model with BILLWERK+ Subscription Management & Recurring Billing.

Book a demoA recently published typology study based on anonymized customer data collected in the collection process provides important insights into the personal communication preferences of customer types who are in arrears.

The findings of the study by collection service provider PAIR Finance form the basis for digital and individual customer communication that optimizes the customer journey in claims management (Ghaffari, Kaniewicz & Stricker, 2021).

Why don’t customers pay on time?

It is known from previous studies that an understanding of the situation in which defaulting customers find themselves must be created in order to be able to design communication that is both target-oriented and at eye level (for example, Dominy & Kempson, 2003 or Watson & Barnao, 2009). This includes understanding the reasons a person does or does not make a payment.

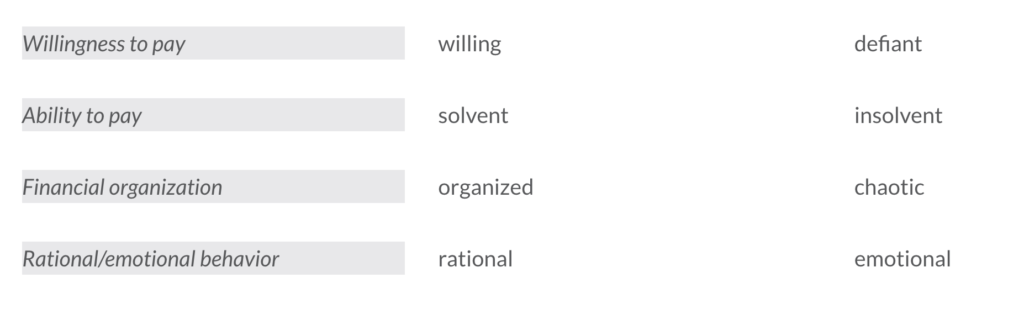

In the past, two dimensions have been used to explain delinquent behavior: willingness to pay and ability to pay (Dominy & Kempson, 2003). PAIR Finance, in examining real data (n = 400,000) from the accounts claims management process, has now been able to identify two additional behavioral dimensions: financial organization and a customer’s emotional behavior.

Each of these four dimensions has two opposite expressions that can be assigned to delinquent customers depending on factors such as their age, gender, communication style, and so on:

The combination of the various characteristics along the four dimensions ultimately results in 16 different customer types, which differ in their response and payment behavior.

Among the almost 400,000 defaulting customers analyzed, five types occurred particularly frequently:

DICE (defiant, insolvent, chaotic, emotional): Typically, these are customers who are in a difficult financial situation and tend to reject any payment solution. They do not engage in any conversation with the collection agency. Even if efforts are made to reduce the fees for them.

WAOE (willing, able to pay, organized and emotional): These customers decide quite quickly to pay the debt. They are in a good financial situation and respond quickly to payment reminders, but can be rather volatile in their communication.

WACE (willing, able to pay, chaotic and emotional): This type of customer tends to pay claims. They are also in an appropriate financial situation. However, they are not able to stick to payment plans, and they also tend to be emotional in their communication.

WAOR (willing, able to pay, organized and rational): This customer type is more likely to opt for a payment solution. He is in an appropriate financial situation, shows a digital affinity, and makes rational financial decisions by paying in response to reduction offers.

DICR (intransigent, insolvent, chaotic and rational): typically, these are customers who tend to refuse any payment solution and are in financial distress. They also do not engage in a conversation with the collection agency and have gone to collection with large outstanding debts.

Conclusion

Artificial intelligence is about to fundamentally change claims management. It is the key to making debt collection an effective part of the customer journey. PAIR Finance’s study shows: With rapidly changing consumer behavior, companies must rely on dynamic solutions that take individual behavior into account, especially in their communications.

The Corona pandemic in particular has underscored the importance of unique payment experiences tailored to each individual in the new boom of digital subscription models to increase customer lifetime value. Today’s sophisticated consumers demand modern and personalized communications across the entire customer journey. This can be achieved today through the use of Artificial Intelligence, Behavioral Psychology and Data Science.

Bio of Christian Zingel

Christian Zingel is Chief Sales Officer at PAIR Finance, the leading fintech for AI-based receivables management in Germany and Austria. Previously, he worked for eBay, ImmobilienScout24, the US tech service provider Yext and Zalando, where he successfully built up divisions and sales units and positioned digital business models.

Christian Zingel on LinkedIn and Xing.

More About Pair Finance

PAIR Finance is the leading AI-based fintech for collections and receivables management. The company enables business customers to recover lost revenue from unpaid invoices with innovative technology, modern behavioral analytics and data science – digitally, efficiently and customer-focused. More than 300 companies from a wide range of industries are already successfully working with the collection solution for the digital age, including Zalando, Klarna, ShareNow, Jimdo and Sixt. The fast-growing company, founded in Berlin in 2016, has more than 130 experienced employees and is led by founder and CEO Stephan Stricker.