ROI | Return on Investment

The so-called return on investment, or ROI for short, is a key figure that reflects the success in relation to the capital employed.

Definition ROI – What is Return on Investment

One of the main concerns of any entrepreneur is how to invest their money and ensure that it yields a profitable return and revenue. The so-called return on investment, or ROI, is a very common approach to investment analysis and is also used to determine financial returns. The return on investment is thus a ratio calculated from the return on sales and the capital turnover, from which the relationship between invested capital and achieved profit is derived.

It makes it possible to see, by means of a rate of return, how much an investor has earned or lost in relation to the value applied to a given investment, which makes it possible to look at the past and the future. It is not only a metric for investments in projects or campaigns, but also for the acquisition of, for example, a new machine or production plant.

This index is used in mechanical engineering as well as for evaluating investments in online marketing or in the subscription economy. To calculate the ROI, the total capital of a company is always used, which consists of equity and debt.

Calculate ROI

Before we go deeper into the calculation, it is important to know the elements that make up this formula:

- Costs: the most obvious element is the cost. Because in order to know the ROI, it is necessary to know the amount invested, the amount spent on the investment;

- Outcome: the difficult part of the ROI calculation formula lies in this element, which can also be called the profit achieved. The result can be anything from the number of subscriptions to a lower churn rate. So it’s always good to have a way to compare how the number of subscriptions, their value, and the average lifetime value (CLV)of the subscription has evolved over time.

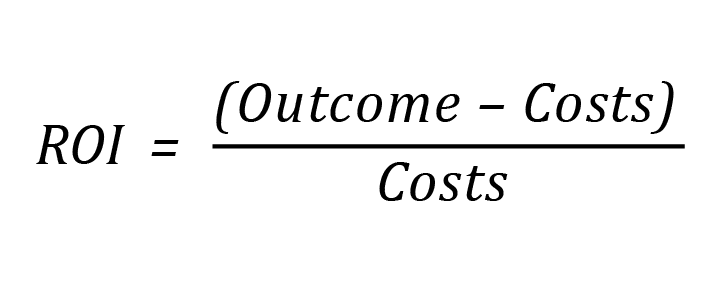

ROI formula

With these unique elements, it becomes easier to make the final calculation. The ROI formula is quite simple. It ends up being simply the division between the results minus the costs, divided by the same costs. This means:

Formula and calculation of ROI

Calculate ROI

For example, if a company invested 5,000 euros and achieved a result of 15,000 euros, its ROI is 2.0, i.e. for every euro spent, the company received 2 euros.

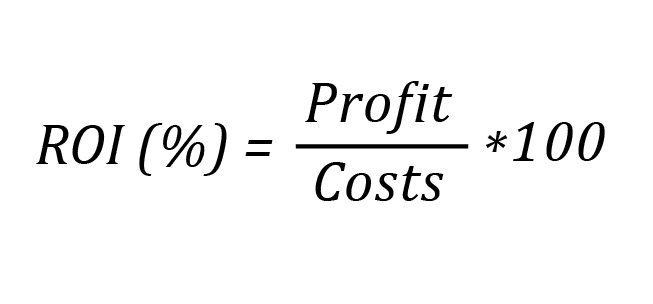

Calculate ROI as a percentage

The return on investment is a ratio that can also be defined as a percentage. In this case, ROI can be calculated by dividing the profit generated by the investment by the amount spent on the investment and multiplying this quotient by 100 as follows:

Using this methodology, it is also possible to measure the net profit generated by a company. In this case, we simply replace the result in the above formulas with the net profit. Before making the calculation, it is important to take into account all the variables related to the business that may affect the net profit, such as website operations, marketing costs, etc.

Return on Investment Analysis Details

Unlike other investment analysis metrics such as ROE, ROA or ROCE, ROI provides a broader “investment view” of the asset or measure under investigation. ROI compares the returns generated by an investment by overlaying the net gains of the investment by its costs, thus showing a relationship between the two.

It should be remembered, however, that ROI alone is not a sufficient basis for defining whether an investment is good or not. Indeed, simply calculating its value says nothing about the likelihood that the expected returns will actually occur as predicted.

In other words, ROI says nothing about uncertainty or risk. It simply shows how the current returns will behave relative to the costs incurred after a situation has already been observed.

For this reason, it is also advisable to estimate the probabilities of various ROI outcomes, such as by developing worst-case and best-case scenarios, and to consider both the magnitude of the metric and the associated risks when making decisions. The implication is that decisions about major businesses and investments should not be made on the basis of a single KPI.

Conclusion: Helpful key figure for the estimation of investments

In order to achieve an efficient ROI ratio, it is essential that the investor understands how it affects his targets. The return rate can fluctuate significantly during short periods of time, which is also due to seasonal effects . Therefore, it is always advisable to follow the index closely in order not to run the risk of being surprised.

It is very important to set realistic goals and constantly monitor them. Often the entrepreneur is not aware of the indicators that show the financial health of the company. Also, not only the ROI analysis should be the focus of the entrepreneurial action, but also other key figures such as ROE, ROA or also especially in the subscription business ROR.